FOLLOW

@AMITMANHASREALESTATE

My blog is written with you in mind; to help answer your questions and share professional insights so you can reach your real estate goals with ease.

I'm Amit

MARKET REPORT

SELLING

BUYING

The Bank of Canada announced another raise in interest rates on April 13, 2022 by a further 0.5%. This is the second increase this year. You might be questioning whether or not to buy a home right now. Perhaps you’re thinking, and hoping, that rates will fall if you wait. But with mortgage rates forecast to keep rising this strategy could end up costing you more.

In this post, I’m going to break down what the raise in interest rates actually means from a buying perspective so that you can succeed in your decision making.

PRICES VS RATES

Your mortgage approval is based not just on the list/offer price of the property, but also on the interest rate of your mortgage. Starting a home search today is therefore going to be different from say 6 months ago, due to the raise in interest rates – even though the list price could be the same.

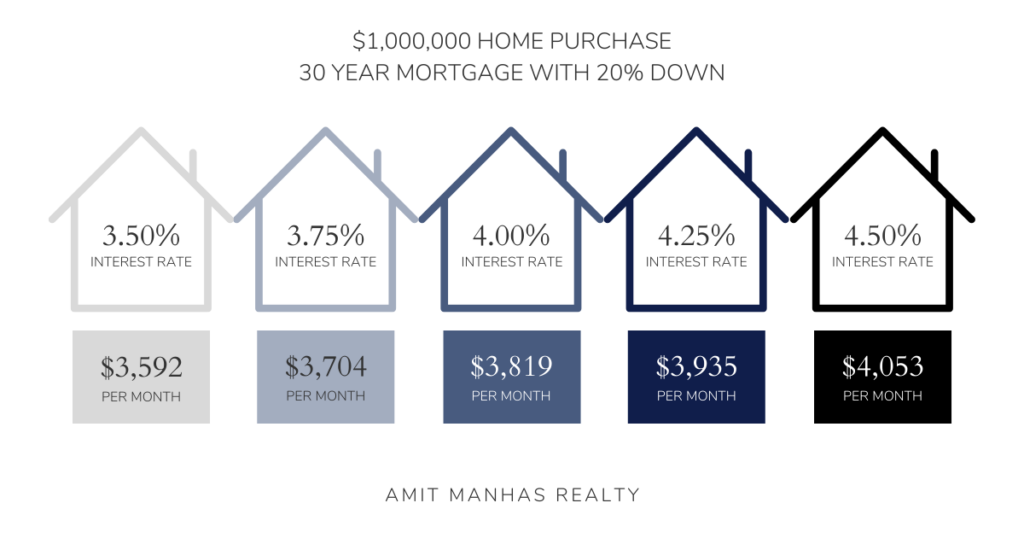

Interest rates affect how much you can comfortably afford on a monthly basis. Therefore, it’s beneficial to buy when rates are low, as opposed to when prices are low.

Here’s an example:

UNDERSTANDING THE MORTGAGE PRE-APPROVAL PROCESS

I can’t stress enough how important it is to get a mortgage pre-approval BEFORE you start searching for a new home. A mortgage broker will find you the best rate and mortgage package. Your lender, together with your mortgage broker will determine how much you can afford. Here are the benefits of getting pre-approved for a mortgage:

- You know in advance exactly how much you can borrow

- Makes searching for a home easier as you know your price range

- You can lock in interest rates with your mortgage broker up to 90 days while looking for a home

- Helps with negotiation as sellers see you are a prepared and serious buyer

- Half of the work is done in arranging financing once it is time to finalize your mortgage

BANK LENDING PRINCIPLES

Mortgage approval amount is calculated based on two lending principles:

- Gross Debt Service Ratio (GDSR) – your total monthly housing costs* should not exceed 32% of your gross monthly household income

- Total Debt Service Ratio (TDSR) – your monthly housing costs* and all credit payment obligations should not exceed 40% of your gross monthly household income

Securing a lower mortgage interest rate is highly advantageous as it can make all the difference as to whether or not you can afford that million dollar home when stacked against the GDSR and TDSR calculations. A 1% difference in interest rate and $500 added to your monthly payments will determine your budget.

While you may feel an urgency to buy sooner rather than later, I want you to think about one more thing before you start panic buying (because nothing good comes from buyers remorse).

THE BOTTOM LINE

When the world started to feel the financial pinch the pandemic caused in early 2020 interest rates hit rock bottom low. The raise in interest rates now certainly seems startling by comparison! But it’s important to remember that they are merely returning to ‘normal’ (for now).

For buyers, perhaps the biggest takeaway is that a higher interest will always cost you more.

Working with a trusted real estate advisor will help you understand and maximize your budget so that you can be prepared to buy your home quickly, before rates climb even higher.

AMIT MANHAS

My goal is to help you find the right home so that you can continue living the life you dream of. I ensure that no details fall through the cracks; giving you the best possible deal.

Known for getting the job done, and exceeding your expectations. Let’s discuss how you can position yourself for success in today’s real estate market.

From negotiations to paperwork, buying a home can get overwhelming fast. Want some inside knowledge?

The Ultimate Home Buyers Guide

free download

Site Credit

© 2025 Amit Manhas | All Rights Reserved | Terms of Use |

Comments Off on How Does The Raise in Interest Rates Affect Your Budget?